GST Special Alert 2023

New rules on GST invoicing apply from 1 April 2023. These changes have been designed for 21st century business record-keeping and modernise invoicing rules in place since 1986, based on paper-based record-keeping systems.

The rules are permissive, so businesses can issue current tax invoices without falling foul of the new rules. However, this doesn’t mean you can ignore them. Your suppliers and customers may introduce changes to their systems stemming from the new rules. You need to be ready to cope with receiving ‘taxable supply information’ in different formats, as opposed to a ‘tax invoice’.

It’s important to note there are no changes to the imposition or calculation of GST – these new rules only relate to information requirements.

A major component supporting the GST system’s integrity is the provision of prescribed information about taxable supplies contained in a tax invoice. Considerable changes have occurred in business practices relating to transactional information and technology since GST’s introduction over 35 years ago, and the new rules reflect this. They are less prescriptive, allowing the way supply information for goods and services is created, provided, and retained to be determined as part of normal record-keeping processes.

From 1 April 2023 businesses must retain a minimum set of information relating to transactions, and are no longer required to issue a ‘tax invoice’ for GST purposes. Don’t forget, however, that normal commercial and contract law still require invoices and record-keeping requirements. Invoices must still be used to notify the customer of their obligations for a taxable supply, but from 1 April 2023 an invoice will not need to meet the old prescriptive requirements such as displaying the words ‘tax invoice’.

‘Taxable supply information’ is effectively replacing tax invoices and must be retained and able to be provided.

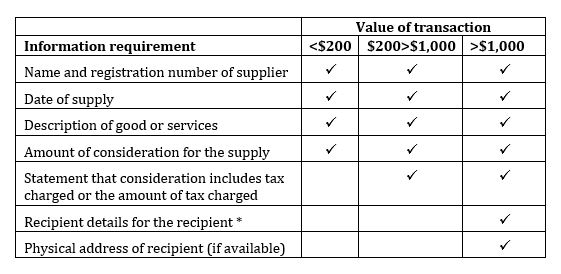

The information required is dependent on the value of the transaction.

* Recipient details require the name of the recipient and one or more of the following:

- Address of a physical location

- Telephone number

- Email address

- Trading name other than the name of the recipient

- New Zealand business number (NZBN)

- Website address

Requirements around credit and debit notes are similarly revised. Formal GST credit and debit notes will no longer be required, however information known as ‘supply correction information’ must be retained. This includes information on inaccuracies corrected such as incorrect descriptions of goods or services, places/times of supply or suppliers/customers.

You must provide supply correction information where the taxable supply information previously provided to a recipient has an incorrect amount of GST, or where you included the incorrect amount of output tax in a GST return. You must provide this information by a date agreed between you and the recipient, or if no date is agreed, within 28 days of the date of the taxable supply information that contained the mistake.

Where the GST shown in the taxable supply information is greater than the eventual GST charged due to a prompt payment discount or an agreed discount which are part of usual business terms, you won’t have to provide the supply correction information.

What about Buyer-Created Tax Invoices?

New buyer-created taxable supply information follows the same criteria as the normal taxable supply information, depending on the value of the transaction, i.e. whether it’s less than $200, or up to $1,000 etc. More importantly, you no longer need Inland Revenue approval to use buyer-created taxable supply information (previously required for buyer-created tax invoices). However, both parties to a buyer-created taxable supply arrangement must agree that only the recipient will provide buyer-created taxable supply information and you must record the reasons, if they are not part of the normal terms of business between the parties.

Note any existing Inland Revenue approvals to use buyer-created tax invoices are not affected.

Even though the new rules still allow ‘tax invoices’ to be issued after 1 April 2023, it is important to make sure you think about:

- Your accounts payable processes. Do your systems or staff automatically reject invoices which don’t have the words ‘tax invoice’ on them? If so, review this as your suppliers (and customers) may update their systems for the new rules. You may receive invoices after 1 April 2023 which don’t have these words on the invoice. The same will apply for credit notes, debit notes and buyer-created tax invoices.

- Your information management systems. Review your systems to ensure supplier and customer databases can handle the taxable supply information requirements, especially recipient information (e.g. physical address and NZBN options).

- Reviewing arrangements with suppliers and customers where buyer-created invoicing is more appropriate. Where you are entering into new buyer-created taxable supply information arrangements, you will need to retain the correct records (including copies of the agreements).

- The time of supply rules. Certain transactions will have a different time of supply to the date the invoice is created. From 1 April 2023, the time of supply must be included in taxable supply information.

- Training your staff on the new rules, including on what is required to support GST input tax deductions. As well as a refresher on GST, it will also give you the opportunity to review supplier/customer arrangements and ensure all business/trade terms are current and comply with the new rules.

- Progressing towards e-invoicing if you haven’t already. These new GST invoicing rules have been introduced to cater for technology and business processes. More efficient invoicing processes could benefit your business.

April 2023 is not that far away. Please contact us to help you assess what your business may need to do before then!